Car depreciation calculator tax deduction

The standard mileage rate method or the actual expense method. What Are the Section 179 Tax Deduction Write-Off Limits.

Tax Deduction Calculator Sale Online 50 Off Www Ingeniovirtual Com

For a summary of this content in poster.

. Alternatively if you use the actual cost method you may take deductions for. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. To elect the Section 179 tax deduction qualifying assets must be purchased and put into service during the tax year for which you are electing the deduction.

As a business owner you can claim a tax deduction for expenses for motor vehicles cars and certain other vehicles used in running your business. 27000 business kilometres 30000 total kilometres x 7000. 1 Tax calculation is only an.

Input the current age of the vehicle - if the car is new simply. 18100 First-Year Depreciation for Qualifying Models In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200.

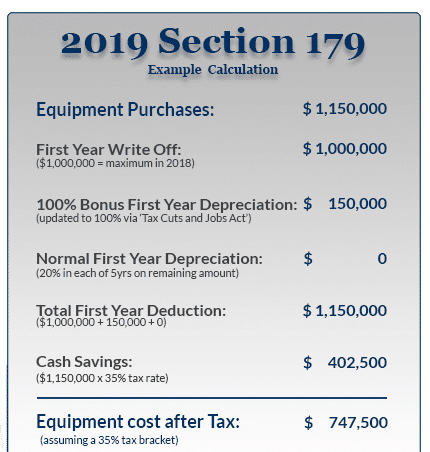

We will even custom tailor the results based upon just a few of. Example Calculation Using the Section 179 Calculator Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2550000Also the maximum section 179 expense deduction for.

Most calculators use data including. Another stylish and safe vehicle. Base Value x Days held 365 x.

7 For example lets say you spent 20000 on a new car for your business in June 2021. The diminishing value method tends to magnify the depreciation amount in the earlier years. Its GVWR meets the criteria for the accelerated vehicle tax deduction with a weight of 6834 to 7077 lbs.

Select the currency from the drop-down list optional Enter the purchase price of the vehicle. The deduction limit in 2021 is 1050000. If accelerated this car can give you a.

A vehicle expense calculator helps you calculate the amount you can claim as a tax deduction for work-related car expenses for eligible vehicles. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. You use the car for business purposes.

The write-off dollar limits for smaller vehicles used for business purposes over 50 of the time including the Section 179 deduction. Murray calculates the expenses he can deduct for his truck for the tax year as follows. Total expenses for the truck 7000.

It can be used for the 201314 to 202122 income years. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Assets from before 10 May 2006.

You can generally figure the amount of your deductible car expense by using one of two methods.

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

Difference Between Tax Depreciation And Book Depreciation Difference Between

Free Macrs Depreciation Calculator For Excel

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

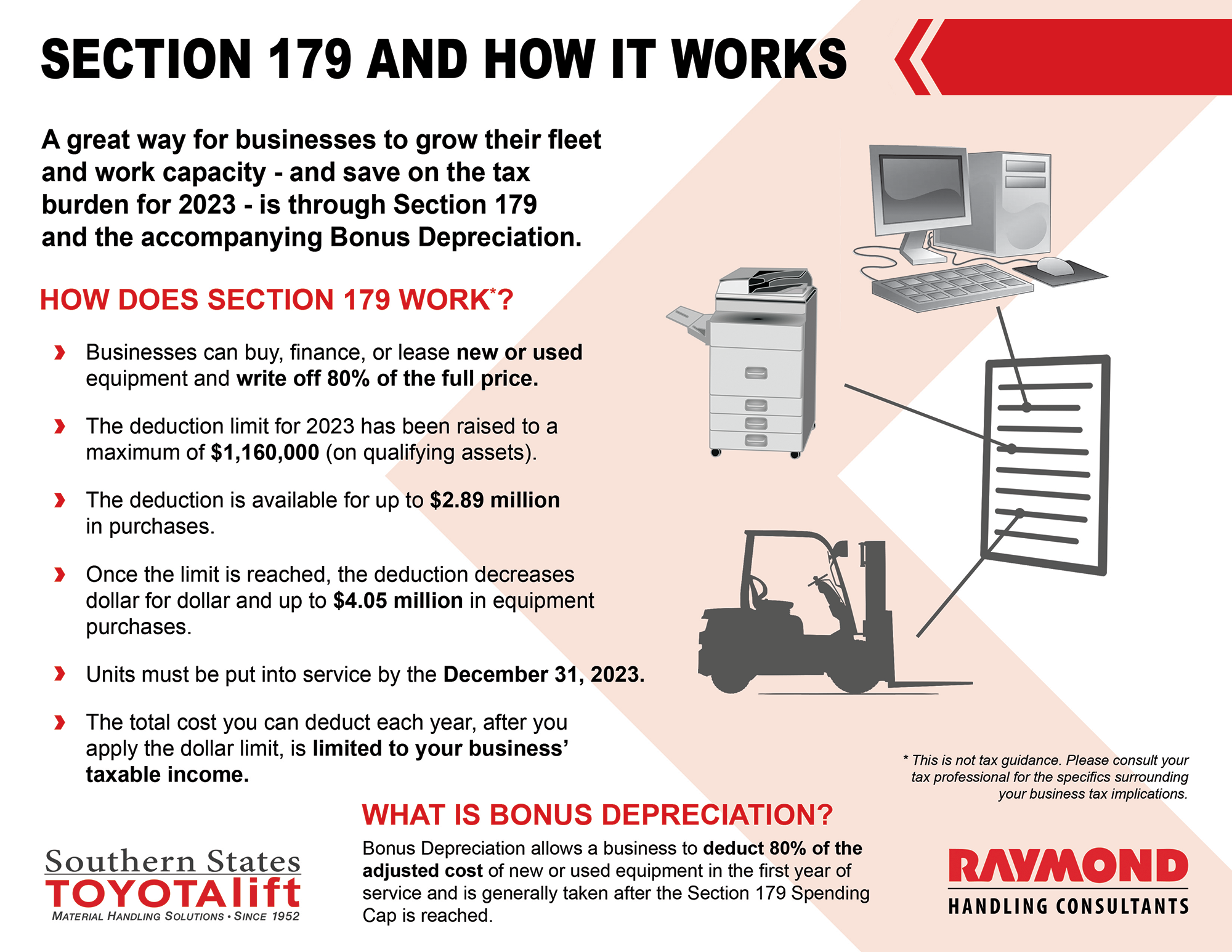

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Real Estate Lead Tracking Spreadsheet Tax Deductions Free Business Card Templates Music Business Cards

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

Irs Updates Auto Depreciation Limits For 2020

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Maximizing Tax Deductions For The Business Use Of Your Car Business Tax Deductions Tax Deductions Small Business Tax Deductions

Tax Deduction Calculator Sale Online 50 Off Www Ingeniovirtual Com

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips