Controllable margin

Ais usually higher than the contribution margin. Bis usually lower than the contribution margin.

How Can I Calculate Break Even Analysis In Excel Analysis Excel Checklist Template

When the controllable fixed costs are reduced from that contribution.

. This can be computed by deducting the controllable fixed costs from. Managerially it is that margin that you can reasonably. A Controllable margin Return on investment Average operating assets 500000 2010 from ACCT 2302 at Tarrant County College Fort Worth.

How can margin be calculated. Total gross sales - total variable costs controllable margin. Managerially it is that margin that you can reasonably expect from a process that is.

How do you calculate ROI with controllable margin. To calculate margin start with. Return on investment is often expressed as follows.

A measure of managements effectiveness in utilizing assets at its disposal. A division of the company that has fewer costs than the other divisions. Its current operating assets are 300000.

Technically CONTROLABLE MARGIN is the difference in contribution margin between controllable fixed costs and controllable fixed costs. Return on investment is often expressed as follows. CONTROLLABLE MARGIN technically is the excess of contribution margin over controllable fixed costs.

When only controllable expenses are reduced from the total revenue of the company it is known as controllable profits. Controllable margin ROI - Average operating assets. Cis always equal to the.

Black Company P3000000 1 2 1200000. Controllable margin is used as a refined measure of strategic business unit from ACCT 201 at California State University Long Beach. Controllable margin is useful for performance evaluation as it is a measure of how managers control revenue and cost.

A centre evaluated by the rate of return earned on the assets allocated to the centred. Controllable margin is considered to be the best measure of a managers performance in efforts to control revenues and costs. To calculate controllable margin you subtract the variable costs from your total gross sales.

The formula looks like this. 104The dollar amount of the controllable margin. A centre evaluated by the rate.

Up to 24 cash back Definition of Controllable Margin technically is the excess of contribution margin over controllable fixed costs. The division is considering purchasing equipment for 90000 that will increase. Controllable margin is thought to be the.

The part of sales revenue over and above the variable costs is called contribution margin. Data for the following subsidiaries of Timmons Company which are operated as investment centers are as follows. Controllable margin ROI - Average operating assets Controllable margin Sales Sales Average operating assets b1 Comparative data on.

Shows budgeted and actual ROI below controllable margin Return On Investment ROI Return On Investment ROI. The current controllable margin for Henry Division is 123000.

Strategic Account Manager Commission Structure Compensation Plan Bonus Structure Accounting Accounting Manager How To Motivate Employees

Pin On Comparisons

Contribution Margin And Break Even Points Managerial Accounting Tutorial 13 Cost Accounting Contribution Margin Accounting Notes

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And T Contribution Margin Income Statement Cost Of Goods Sold

Sales Mix And Cost Volume Profit Analysis

6 Things Before Investing In 2022 Investing Budgeting Finance

How To Calculate Contribution Margin In 2022 Contribution Margin Accounting Education Accounting And Finance

Contribution Margin Contribution Margin Financial Analysis Accounting And Finance

What Is Unit Economics Definition Importance Model Economics The Unit Customer Lifetime Value

Contribution Margin Contribution Margin Managerial Accounting Contribution

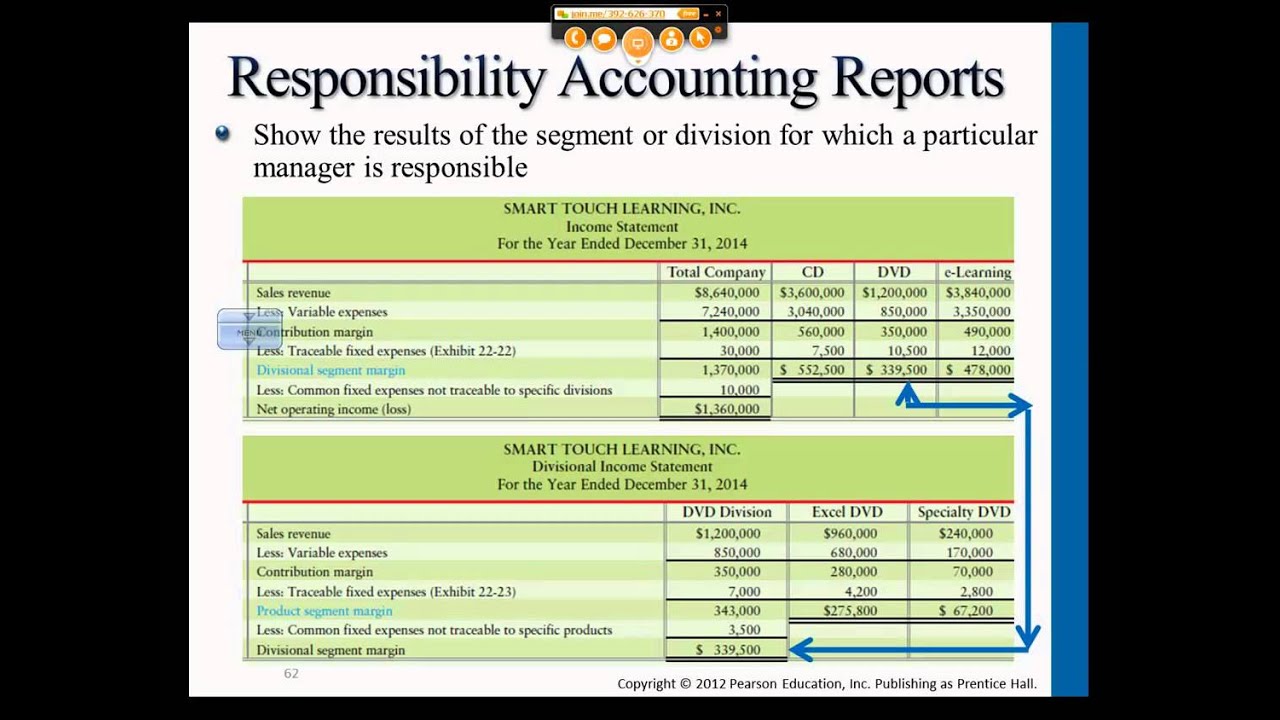

Ricardo Montemayor Franco This Is A Video That I Found On Dropping Unprofitable Products And Segments I Like This Video Simple Math Fixed Cost Segmentation

Contribution Margin Vs Gross Margin Contribution Margin Gross Margin Accounting Education

Differences Between Contribution Margin Vs Gross Margin Contribution Margin Gross Margin Contribution

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverage Also It Breaks Down Contribution Margin Sales Var

Intro To Managerial Accounting Preparing Performance Reports Flexible B Managerial Accounting Report Template Budgeting

Truc Nguyen This Video Briefly Explains About The Contribution Margin And The Contribution Margin I Contribution Margin Managerial Accounting Income Statement

Cvp Analysis Guide How To Perform Cost Volume Profit Analysis Financial Statement Analysis Financial Analysis Analysis